50,000 if you also pay health insurance premium for your parents below 60 years of age.Īlso Read: Tips to Conside Before Buying Health Insurance in India 7. Proofs of Capital Gains 25,000 for yourself, spouse, and children.

The maximum deduction you can avail by using insurance receipts as income tax documents is Rs. 6. Health Insurance Premium ReceiptsĪpart from income tax documents related to the tax-saving investments, the health insurance premium paid during FY 2019-20 is eligible for deduction u/s 80D of the Income Tax Act. With all the required income tax documents, the maximum deduction you can claim under these sections is Rs. The proofs of investments in Employee Provident Fund (EPF), Public Provident Fund (PPF) and Life Insurance, thus, form the part of income tax documents you need to file ITR.

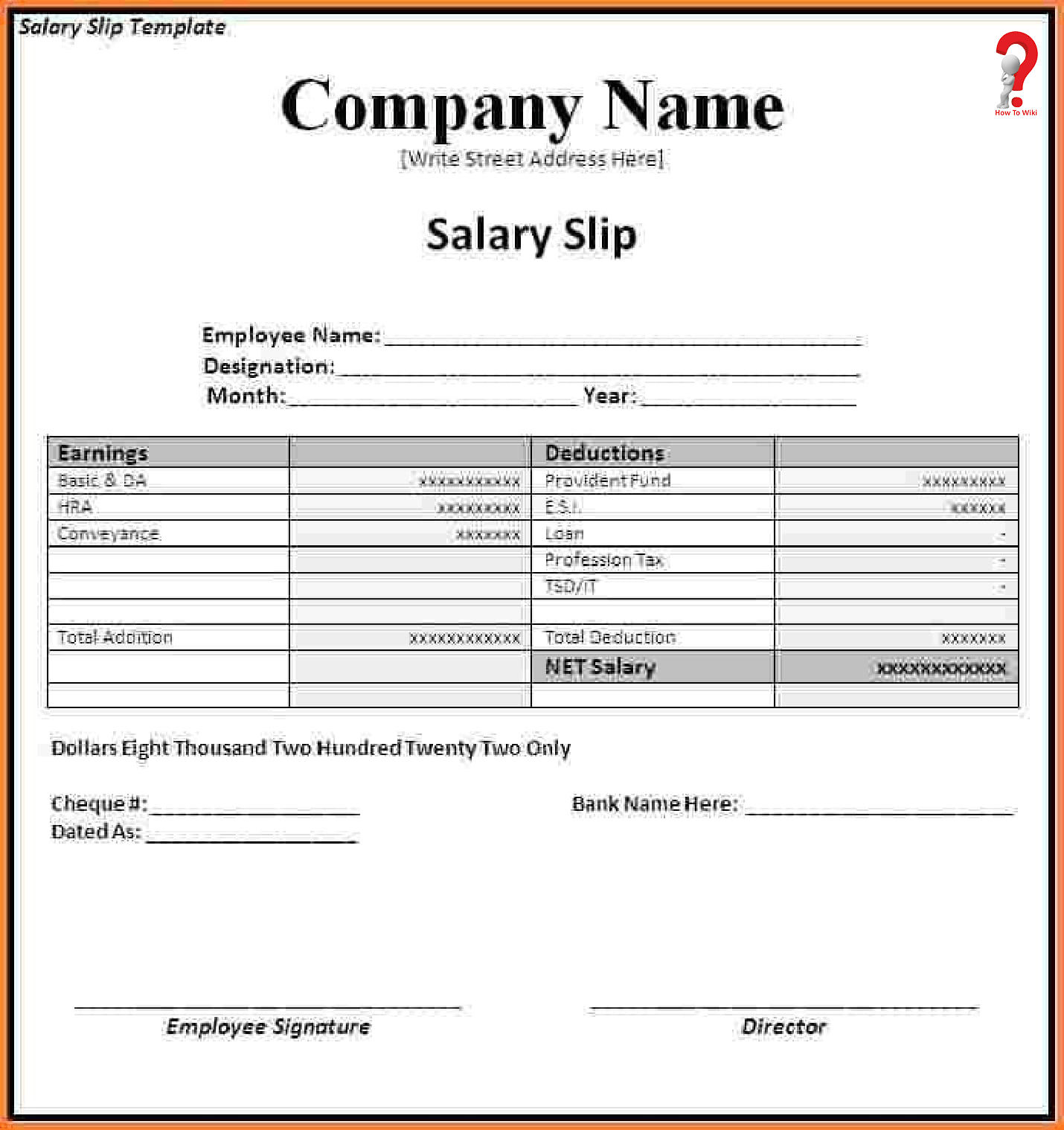

Under section 80C, 80CCC and 80CCD(1) during FY 2019-20, the tax-saving investments made by you can help in lowering the tax liability. Therefore, you must get interest certificates from the respective banks/post office, which will work as the income tax documents required to file ITR. The interest you receive from a savings bank account, savings account in the post office, or Fixed Deposits (FDs) are taxable. 4. Interest Certificates from Post Office and Banks These slips provide information about House Rent Allowance, Transport Allowances, and other allowances which have different tax treatment. 3. Salary Slipsįor salaried taxpayers, their latest salary slips form a part of the income tax documents required for Income Tax Return e-filing. What makes it one of the essential income tax documents is the details it carries, which include tax deducted from salary, employees’ PAN, employer’s PAN and TAN, and gross salary breakup. It is a TDS certificate issued by their employers to provide details on the TDS deducted on their salary. 2. Form 16įorm 16 is one of the most crucial income tax documents required by salaried individuals to file ITR.

Under Section 139AA of the Income Tax Act, every Indian taxpayer must provide his/her Aadhar card details while filing ITR. Your Aadhar card and PAN card are two essential income tax documents required for ITR filing. Here is a list of income tax documents required for Income Tax Return e-filing: 1. Aadhar and PAN Card

0 kommentar(er)

0 kommentar(er)